DON'T WAIT FOR THE TAX DEADLINE!

FILE YOUR 990EZ -KEEP YOUR TAX EXEMPT STATUS

Organizations that are exempt from income tax under IRC section 501(a) are required to file an annual information return, The return is due on May 15 for calendar year filers. Let us help you file your return on time without the fear of loosing your tax-exempt status.

YES, I need this! Sign me up for only $9.90!Here is what many may not know...

If you fail to file, you run the risk of losing your tax-exempt status and will have to reapply, meaning you’ll be responsible for paying taxes on your organization in the interim. And that’s no fun at all. ?

For nonprofits like yours, all of your funds will be reinvested in your mission. That’s what it means to be a nonprofit. You don’t make a profit. Therefore, any taxes the government were to take out would only take away from your mission, and they don’t want to do that. The U.S government willfully allows billions of dollars to go uncollected for organizations like yours to help make the world a better place.

INTRODUCING

The File Your 990EZ Course

Your step-by-step process to help you file your 990EZ, stay compliant and have a record of financial accountability for funders. We dive deep into the process of 990EZ filing and tell you why filing this form is better than just filing the 990N Postcard.

You Will Discover

What are my filing responsibilities once I receive/apply for my tax-exempt status?

You Will Learn

Form 990 Series Which Forms Do Exempt Organizations File and When

You Will Complete

How To Fill Out A 990EZ Return

When you are confident the process

you're able to take action

LESSON ONE

Exempt Organization Annual Filing Requirements Overview

HERE IS WHAT WE WILL COVER:

✔ Learn your filing requirements specifically for your organization's size and finances

✔ What it means to be a small organization when filing.

✔ What gross receipts and assets mean so you account for them correctly.

LESSON TWO

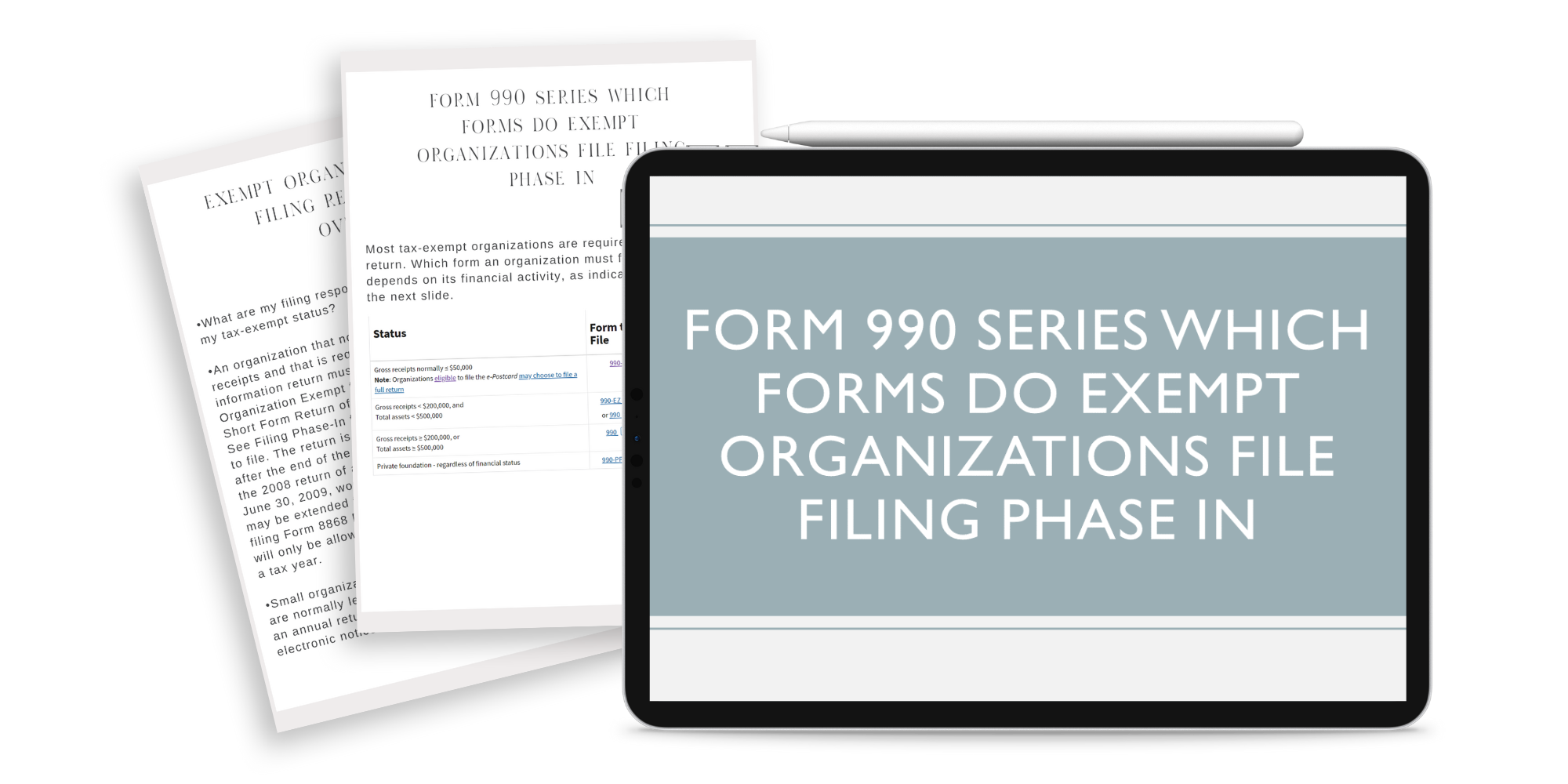

Form 990 Series Which Forms Do Exempt Organizations File Filing and When

HERE IS WHAT WE WILL COVER:

✔ Understand the filing requirements for all tax-exempt organizations (some do not have to file. Churches are NOT required to)

✔ Find out where to file your return so that it is accepted by the IRS.

✔ Discovery what's new in filing requirements and what's changed with form 1099 NEC

LESSON THREE

How To File Your 990EZ (Complete Walk Through)

HERE IS WHAT WE WILL COVER:

✔ How to add your organization's information to the form.

✔ How to show an accounting of the resources that have come into the organization.

✔ The correct additional schedules you'll need to file in the process.

wait! thats not all!

Gain exclusive access to these bonuses!

Your 990 EZ Workbook

hey there!

We're Angela & Victor!

THE MYLES FACTOR

We are Angela & Victor Myles, and we are the award-winning, highly recognized Ministers of Business at The Myles Factor, and founders of The Fundable Church Online Learning Center and The Fundable University. We specialize in fundable solutions and nonprofit business growth strategies. We help faith-based nonprofit leaders successfully Build, Fund, Grow and Lead Sustainable Organizations So They Can Fund The Vision, While Making The Move To Full Time CEO Without Losing Their Faith Identity. We are not new to this; We’ve created an impact over the last 14 years. Eight of those years we spent leading as Nonprofit Executives of a faith-based nonprofit (church), serving over 20,000 people and securing over $10M in funding and resources. For the past 6 years we’ve helped hundreds of faith-based nonprofit visionaries make the move beyond formation because of our strategic approach to leadership growth and organizational expansion!

Did you know that

Public charities are exempt from federal income tax, yes. But, the Internal Revenue Code requires most of these organizations to report information every year by filing the Form 990. The 990 verifies that the nonprofit still qualifies for tax exemption. It’s public record, and it helps inform the public about the organization’s programs and operations.

The Pension Protection Act of 2006 provides for automatic revocation of an organization’s tax-exempt status if it fails to file a required annual information return for three consecutive years. In June 2011, the IRS enforced this provision for the first time by publishing a list of about 275,000 organizations that lost their tax-exempt status for failing to meet their annual filing obligations for three consecutive taxable years. (https://birkenlaw.com/blog/6-ways-lose-501c3-irs-tax-exempt-status/)

It is your time now to make sure you stay in compliance.

xoxo The Myles

frequently asked questions

When To I Get Access To The Course

Do I Have To Be A 501c3?

When is the Form 990 filing deadline?

What is the nonprofit Form 990?

Does my nonprofit also file state tax returns?

Why You File the Nonprofit Form 990

What Others Say About Our Training

- Pastor Pam

- Angel H

- Ivah A

Are You Ready to File Your 990EZ With Confidence?

© 2016-2025 THE FUNDABLE CHURCH | PRIVACY & TERMS |